Dear Friends,

In a move in which the timing was more compelling than the decision itself, the Federal Reserve announced last week that it unanimously decided to cut its policy rate by 50 basis points (0.5%) from the 1.5-1.75% range to the 1-1.25% range. The surprise move marked the Fed’s first rate action outside of a regularly scheduled meeting since October 2008.

In the short run, the rate reduction did little to return the markets to normal, but some analysts are predicting further cuts by July.

Want to View My Video Discussing the Coronavirus?

Click Here

The surprise move was likely calibrated to increase the impact of the decision, one in which could be more aptly compared to the rate cut in 1998 in response to the Russian financial crisis and failure of the hedge fund Long-Term Capital Management, rather than the recessionary cuts of 2001, 2007, and 2008. Keep in mind that before 1994, the Fed did not change policy around a meeting schedule, so effectively all rate changes were unannounced.

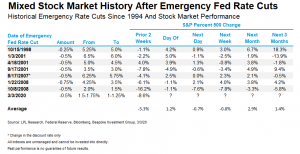

Stocks historically sold off ahead of these moves, before getting a short-term bounce on the day of and the month following these announcements (see chart). However, performance over other periods shown has been mixed.

I believe the Fed is acting out of appropriate caution to help the economy through what is likely to be an economic soft patch before a potential rebound in the second half of the year, with more room to ease if needed.

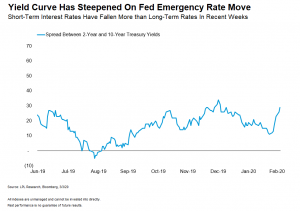

The Fed’s action has helped to steepen the yield curve, or the spread between short and long-term interest rates. As shown in the next chart, the spread between 2-year and 10-year Treasury yields has risen sharply to around 30 basis points (0.3%), reversing this negative economic signal that has historically been a good predictor of recessions, though with widely varying lag times.

I am continuing to monitor this situation and will keep you posted as the news warrants. Of course, I am always available to talk about your goals and how economic events may or may not change the roadmap of your financial strategy. Feel free to give me a call or send me an email anytime.

Sincerely,![]()

Richard Sturm

Managing Partner / Account Executive